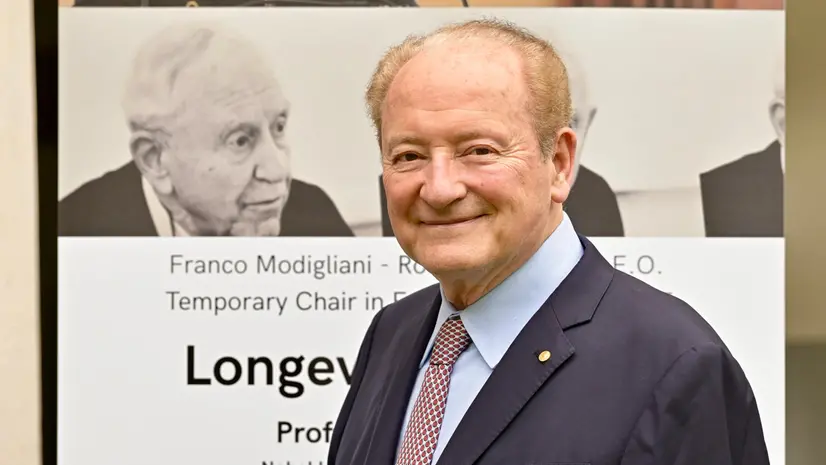

Robert Merton, l’intervista integrale al premio Nobel per l’Economia

Ospite del dipartimento di Economia e management dell’Università degli Studi di Brescia, il professor Robert Cox Merton, premio Nobel per l’economia nel 1997, ha parlato di sistemi pensionistici, lavoro, politiche tariffarie e inflazione. Di seguito proponiamo l’intervista in versione integrale e in lingua originale.

The demographic winter is under way in all the western countries. How do you explain and comment on it? Which policies should be adopted by any administration and government to reverse course? How the immigration must be regulated to fill the voids both in the Us and Europe?

Let’s make sure we define the term «demographic winter»the same way: yhis term refers to the combination of decline in birth rates and growing aging populations across many Western countries. It is not just a temporary trend, it is a deep structural shift that is reshaping economies, labor markets, and social systems.

This combination is devasting for the sustainability of traditional social security pay-asyou-go (Paygo) retirement systems because as the number of current recipients of benefits increases and the number of workers available to pay those benefits declines, the system will eventually fail because each worker will have to pay for their own family plus an increasing larger fraction of a retiree’s total living expenses which is itself increasing with longer life expectancy, without adjusting the retirement age.It is a reflection of how modern societies prioritize family, work, and the future. Reversing it requires deep cultural change, and long-term investment. Governments must treat demographics like national security: because the long-term survival and strength of a society depends on it.

First, most Western countries are below replacement fertility which is 2.1 children per woman. In Italy, Spain, Germany, and Japan, rates are around 1.2 to 1.4. In the U.S., we have seen a consistent decline, now close to 1.6. One reason for this is a delay in starting a family, some young people perhaps feel the pressure of economic insecurity which may force them to both have jobs outside the home to pay for their living. If both are working outside the home, this serves to increase the labor force that supports retirees which helps to mitigate the ratio of workers per retiree. However, the financial cost of having a child increases, because those families will need to pay for child care if they are not at home to do it. To be economically viable, what each in the family earns has to be greater than the cost of that child care. To address this, they focus on career prioritization to improve earning power, which delays starting a family and makes the economic cost of having each child greater. Higher education levels, higher paying jobs and urban living tend to correlate with fewer children, particularly among women. Second, increased longevity means we live longer, which is great news, but a growing share of the population is retired and dependent on younger workers, shrinking the labor force while increasing pension and healthcare burdens.

So, you may ask why this matters? It matters because it has caused and will continue to cause labor shortage, slower economic growth, unsustainable pension systems, higher healthcare spending, and possibly, weaker innovation since the younger generation is typically the driver of entrepreneurship. As a short-term solution: increasing the retirement age will reduce the cost of funding retirement. Immigration is definitely part of the solution, in increasing both the workers available for the needed labor demand and reducing the per worker burden of paying for current retiree benefits. Countries should proactively have an inclusion policy to integrate the immigrated population into their productive work force. One may call it a Smart, Selective Immigration Policy to fill the immediate gaps in labor shortage in sectors such as elder care, child care, tech, construction, and education. Furthermore, perhaps, governments should invest in language training, education, and legal pathways to citizenship, and create social cohesion to avoid political backlash or ghettoization.

Another short-term solution is to increase the retirement age in line with life expectancy, promote flexible or phased retirement and productive part-time work for older adults. Given the demographic winter conditions, we have to revise the design of the retirement system design. This is already under way as there is a global trend to not depend exclusively on a Paygo system design but for people to take greater responsibility for funding their own retirement. Often called Pillar II, defined-contribution plans have the employer and employee contribute a specified fraction of pay into an individual investment account. The contributions are allocated to a selection of risk assets. The important element is that the benefit received at retirement depends on the investment experience of the contribution and thus, the retiree is now bearing the risk of the outcomes of these contributions. With responsibility for the risk, comes the responsibility to determine how much risk to take. Pillar II is not a replacement for Pillar I, but an addition to provide a full and flexible expansion of the total retirement vehicle. To be effective, we must make Pillar II as easy to use as Pillar I. Furthermore, we need to employ innovative financial instruments such as Retirement security bond (Rsb) which can be adopted by governments. Rsb is a government bond instrument which converts long term savings into a defined benefit pension for citizens. An instrument such as RSB, a subject which I have lectured on extensively while I am here in Italy, encourages private savings and pension diversification.

As a long-term solution, pro-natalist policies may be considered. Examples of such are direct child allowances, Tax breaks for families, Free or subsidized childcare and education, suitable paid maternity and paternity leave, flexible work arrangements for parents and targeted housing support for young families. These are a handful of examples to illustrate that in the long term, we should make it easier for younger population to start a family and allow them to have a more work-life balance.

What is your view on protectionism and the tariff policies implemented by the current U.S. administration?

I am not a specialist in international trade. I generally believe in free trade economic solutions as the most efficient whenever possible. There are, of course, situations in which, ensuring a domestic supply chain for critical goods and services for national security/ defense reasons that may justify the cost of the trade barriers, or to protect against very predatory policies designed to reduce competition. Tariffs are selective taxes which are collectively borne by the producers and consumers. Which pays what fraction of the tariff depends on specific circumstances The producers will not sell their product in the tariff-creating country unless it is profitable enough to do so, net of the tariff paid and will seek alternative countries with lower tariffs to sell. Given that we really do not know the magnitude or duration of the tariffs the U.S. administration will implement, at this time, we cannot do much more than run different scenarios and make conditional forecasts.

Since the cost of changing supply chains and redirecting where products are produced creates substantial fixed costs including a long time to implement, the reaction of producers will depend on the labor and capital costs to manufacture in the U.S. and to assess whether it is a positive present value to make the move, how much they can trust the stability of the tariff policy and whether the agreed to policy will be honored. Given the size and extreme volatility of current US tariff policy and its use as an extreme coercive device, I expect very little willingness to actually move production to the US in response to the tariffs because as a matter of risk management, the producers are likely to retain production outside the US at lower labor and other costs. They will more likely pursue different non-U.S. markets. Once tariffs are finally set, I expect the prices in the US will rise, and that the incidence of the tariff tax will be borne much more by US consumers than by foreign producers Major US retailers and manufacturers, including Walmart, Target, and Ford, have indicated that the new tariffs will lead to higher prices for consumers. On the economic front, analyses suggest that these tariffs could reduce U.S. GDP growth by up to 1.0% in 2025, with potential income losses of approximately $690 annually for the median household. But, of course, absent any finalized range and conditions of the trade agreements, the predictability of these estimates is at best sketchy.

Globally, we have seen retaliatory measures. Furthermore, we have been experiencing market volatility: Financial markets have experienced major fluctuations due to uncertainties surrounding these trade policies. While some short-term gains were observed, long-term investor confidence remains cautious and the fast-paced changes in tariff policy have likely reduced trust in US agreements being fulfilled and not changed radically as a means of forcing renegotiation in the future. If so, then they will likely pursue alternative supply changes and multiple markets outside the U.S. as a national economic security matter.

Do you believe that globalization will not end, but will undergo a transformation, or do you think that a deglobalization process could be triggered that supports local markets?

Globalization will not end, but it will evolve into a more strategic, politically influenced, and digitally driven form. Particularly, I expect the global financial system for capital, saving and investment to remain so even if the nationalism trend otherwise continues. This evolution allows for stronger local markets without fully abandoning international interdependence. A complete deglobalization – cutting economies off from each other – is both economically infeasible and historically rare. Digitalization will make the cost and benefit of global diversification even more efficient for risk-bearing and lowering the cost of capital.

Today, artificial intelligence and blockchain are radically transforming financial markets. What role do you foresee for these technologies in the coming years?

Artificial intelligence (AI) and blockchain technologies are poised to play increasingly transformative roles in financial markets over the coming years. Many financial-science innovations that could not be cost-effectively implemented will now become feasible. Technology moves finance practice toward finance theory. For instance, my most influential research 50 years ago came from models that assumed that decision makers could trade 24/7, continuously in time. Today, finance practice trades globally 24/7 and employs high frequency trading strategies with latencies measured in milli- and micro-seconds, essentially continuously in time. In the area of AI, we can expect advanced Risk Management and Fraud Detection.

AI can improve real-time monitoring and predictive analytics, allowing institutions to identify fraud, market manipulation, or credit risks much faster and more accurately. These technology tools can be employed to lower the cost and support implementation of more sophisticated financial-science-designs for hyper-personalized investment advice, portfolio management, and financial planning, tailored to each person’s particular circumstance and preferences. This customized approach will improve the retirement experience materially without having to earn higher returns to have more assets. Instead, the tailoring will fit what the retiree wants much better than the current generic «one-size-fits-all» solutions and thereby, improve what the retiree receives and reduce significantly the cost of waste from current design solutions.

Financial product solution designs will be created in which all complexity is borne by the producer and the interface design with the customer is based on what that customer already understands and knows how to do. Thus, eliminating the need for financial education and training in order to use the product easily to allow customer to make effective choices. The creation of new financial markets to improve the efficiency of risk sharing and redistribution services to vastly improve financial engineering solutions. It also lends itself to faster and more sophisticated trading algorithms for rapid and deep data interpretation, and an enhanced to anticipate market movements for financial service providers to improve performance at a lower cost.

Blockchain and Distributed Ledger Technology will continue to affect clearing and settlement by enabling real-time, shortening settlement times to near-instantaneous. Some financial solutions are improved by decentralized finance and others are improved by centralized finance. These technologies, properly employed, will support improving both types. Furthermore, they will allow for fractional ownership of real-world assets (e.g., real estate, equities, bonds), increasing liquidity and democratizing access to investments that were previously illiquid or out of reach for many investors. Of course, we can expect AI to be employed to monitor blockchain transactions for illicit activities. These are just few examples.

A few weeks ago, the Vix (Volatility Index) on Wall Street, known as the «fear index», was soaring to very high levels, scaring the world's stock markets. Now, will the high liquidity available become a stabilizer?

The Vix represents the price of insuring against the stock market declining. It is a useful «forward-looking» indicator of the degree of uncertainty surrounding future stock prices. Few would challenge that aggressive and confusing government actions in so many important areas introduced a substantial amount of uncertainty reflected in the soaring VIX. Liquidity is also an indicator of uncertainty. Yes, higher liquidity perhaps interjected by the Fed can act as a short-to medium-term stabilizer, particularly by preventing a crisis of confidence from turning into a financial panic. However, it is not a solution that will overcome poor economic outcomes such as recession and dysfunctional fiscal and other government policy actions. The Vix will fall as uncertainty is resolved but that resolution could be that a feared bad economic outcome is realized. In that case, Vix, the price of insuring the stock market, will fall but so will the stock market Government actions, market fundamentals, central bank policy, and global economic trends must align for sustained stability. In the current environment, liquidity is a helpful buffer, but one that must be supported by improving macroeconomic signals and steady policy communication to truly anchor market sentiment.

When liquidity is abundant – whether from central banks (e.g., loose monetary policy), fiscal stimulus, or large pools of capital waiting on the sidelines – it creates a cushion. Investors and institutions are more likely, reducing the depth and duration of selloffs. Also, high-liquidity can ensure smoother functioning of the credit markets. This helps, keeps companies solvent, supports consumer spending, and prevents forced deleveraging, all of which help stabilize equity and bond markets. Furthermore, if the Federal Reserve or other central banks maintain dovish stances or signal readiness to inject liquidity in times of stress, markets may perceive a safety net. On the other hand, excess liquidity can inflate asset prices beyond fundamentals. If there is fear that loose Fed policy or government deficit spending will increase the national debt, it can cause greater uncertainty. If markets try to stabilize purely because of liquidity rather than improving economic data, they may become fragile, vulnerable to sharp corrections if sentiment or interest rates shift. High liquidity, particularly in a high-interest rate environment or amid persistent inflation, can be a double-edged sword. If inflationary pressures reignite, central banks may be forced to tighten again, pulling liquidity back and triggering fresh volatility. Rising inflation combined with a weakening economy can make finding a Fed policy or government fiscal policy to stabilize the economy very difficult.

Thanks to medical advances, people will live longer. But how can they live better, joining social and economic aspects?

You are right, we are living longer, and the real challenge now is ensuring a better quality of life. To live better, not just longer, requires a societal shift:

• From aging as decline to aging as opportunity

• From isolation to inclusion

• From economic dependency to continued contribution

• A good longevity experience is not possible without financial security in retirement, and so we need to ensure a retirement system that works

Here are some suggestions on how we can reach this goal:

1. Emphasizing prevention over treatment – through regular screenings, healthier diets, physical activity, and mental wellness – will help people stay independent and active longer.

2. Loneliness in older adults is a serious risk factor for cognitive and physical decline. Community programs, intergenerational initiatives, and digital literacy efforts can help keep older people socially connected.

3. Creating a National Job Bank which is suitable for the experienced retirees and uses their comparative/competitive advantages relative to younger workers such as not being tasked with building their career as well as encouraging active roles postretirement – such as volunteering, mentoring, or part-time work – that provides purpose and mental stimulation. People do not just want to live longer; they want to contribute. Because these are real jobs, it will provide a means to work longer for the money needed and will also add to GDP.

4. As lifespans increase, traditional retirement ages become outdated. Flexible, agefriendly workplaces with part-time, remote, or consultancy roles can keep older adults economically active and socially engaged.

5. Ensuring that people can manage their savings, pensions, and healthcare costs is crucial. Providing saving instruments such as RSB will help provide financial security and can be a key to avoiding poverty in old age.

In your opinion, what are the most underestimated systemic financial risks today?

My definition of crisis is not simply large wide-spread loss in asset values, although crisis is generally accompanied with large losses. Crisis is when we have a large loss outcome and we do not know why it happened. The rules of how the economy, the markets and the way things work are not working and we do not know why or what the new rules are. We wake up one morning and all our screens are blank and we do not know why. What we experienced is outside of our «model» and therefore, we cannot prepare for it in the usual way. The best we can do is assemble an array of experienced problem-solvers in advance who can «think outside of the box» in their area of expertise. If we could predict what might happen in advance and work out what to do about it if it happens, it becomes part of our model and thus, execution may be challenging and costly but it is not a crisis.

A good rule of thumb: «The next crisis always comes from what we are not looking at closely enough». Therefore, by definition, we cannot prepare for crisis in the usual way. That said, some systemic risks remain underestimated either because they are slowmoving, hidden beneath the surface, or poorly understood. That is, most of these risks are underestimated because they do not manifest in daily volatility or short-term headlines. But systemic risk is not about what is loud, it is about what is latent. Effective risk management today requires looking at past traditional indicators to interconnected, slow-burning, and non-linear threats that could erupt when conditions shift.

So, what may be some examples?

• For example, climate-related Financial Risk (Physical + Transition Risk): Financial markets likely underprice long-term climate risks due to the absence of well-functioning markets for sea temperature and other indicators of climate change and uncertainty in modeling. Damage to infrastructure, agriculture, and housing affects asset values. Rapid policy changes, carbon taxes, or stranded assets (especially in fossil fuel-heavy portfolios) could hit balance sheets hard.

• Another example can be Sovereign Debt and «Hidden» Fiscal Imbalances. Many governments have ramped up debt during the pandemic and post-crisis stimulus, and some countries are masking their real obligations through off-balance-sheet liabilities. A loss of market confidence or sudden rate hikes could lead to a sovereign debt crisis, especially in emerging markets. Contagion affects banking sectors holding government bonds.

• Another example may be due to the fact that banks and markets rely on digital infrastructure that is increasingly vulnerable, but these risks are not always factored into systemic risk assessments. A large-scale cyberattack could disable payment systems, trading platforms, or even central banks. This may trigger a crisis of confidence, or a liquidity freeze in financial markets.

• One last example: Widespread use of AI in trading and risk modeling could create model convergence, everyone reacting the same way to the same signals. This is tech- inducedherd behavior which can create flash crashes.

What commitment will the banks have to make?

Banks need to shift from a compliance-driven mindset to a systems-resilience mindset. The next systemic crisis will not come from a single point of failure, it will likely be complex, cross-sectoral, and fast-moving. Proactive investment in detection, agility, and collaboration will define the winners in this next phase of financial evolution. In dealing with crisis preparation/prevention, avoid silos of institutions or purpose and recognize that systematic risks likely involve interactive activities among multiple silos, and there is a need to have some entity responsible to look across silos to discover interactive consequences. For example, by cutting interest rates to stimulate consumption for the working population and investment by companies, note that lower interest rates mean that for a given holding of wealth you will not be able to have as good a standard of living because the income the wealth generates will be smaller, and thus instead of consuming more, folks nearing retirement , may feel the need to save more and consume less, exactly the opposite of what was expected from the stimulus of lowering interest rate.

A great investor like Warren Buffett doubled his cash (to over $330 billion), do you think his move is only speculation or a risk diversification strategy?

I, of course, am not privy to Buffett’s reasons. I believe that it is far more likely to be a strategic risk management and diversification move than mere speculation. Buffett’s move is not a bet – it is a highly disciplined, long-term risk strategy rooted in patience and flexibility. In his world, cash is not idle – it is a strategic asset that both reduces risk when he wants it, and also provides strategic opportunity, and resilience. In short: not speculation, preparation. Buffett has always been value-oriented and risk-averse. Sitting on large cash piles is not about timing the market in a speculative sense, it’s about preserving capital in uncertain environments and being ready to act decisively when opportunities arise. This is classic Buffett: wait patiently for moments of panic when others are forced to sell.

Many pension systems in Europe, particularly in Italy, are under severe demographic and financial pressure. What solutions do you suggest for ensuring the sustainability of these systems?

No single structure such as a Paygo traditional pension system will be adequate to solve the pension crisis with a sustainable solution. A composite set of investment vehicles is needed.

1. Continue with Pillar I social security paygo system but do not stress it but promising to cover all or the vast bulk of a typical retirement funding need, key emphasis is on maintaining trust especially among the younger generation of workers that the promised benefits from this source are credible that they will be there for them when they retire if they participate to pay for retirees now.

2. A huge trend everywhere in the world toward people being more responsible for their own retirement with a Pillar II defined-contribution plan where the individual bares the risk of investment outcomes. Not to replace Pillar I but to add to it for greater flexibility to adjust to changing circumstances faced in the futures.

3. The RSB instrument which allows all citizens of the country to save for retirement even if they are part of the informal economy of a country in which they have no formal pension benefit and are responsible for accumulating their entire pension from personal saving. RSB is designed to be as easy to use as a Pillar I pension without requiring an advisor. Brazil treasury issued its version of RSB, RendA+, in 2023. RSB is designed to provide a smooth translation from the accumulation phase to drawdown phase. To make this integrated but flexible retirement solution system work requires a combination of demographic, economic, and structural reforms. Politically, these are difficult moves but delaying them only makes the problem more painful and more expensive.

Putting it very succinctly, to make pensions sustainable in aging Europe, we must work longer, save smarter, include more people, and spend more wisely.

1. Adjust Retirement Age Dynamically and link the retirement age to life expectancy. As people live longer, they should work longer, within reason. Countries like Denmark and the Netherlands already adjust retirement age based on life expectancy projections.

2. Increase Labor Market Participation. Encourage longer workforce participation among older adults (with part-time, flexible options). This should include improving employment rates for women, youth, and immigrants, these groups are often underutilized in Italy and many other countries.

3. Improve the governance and investment strategy of public and occupational pension funds. Diversify assets globally and use risk-adjusted return models to protect against low domestic growth.

4. Strategic Immigration Policy: Targeted, skill-based immigration policies to offset demographic decline and replenish the tax base. Furthermore, ensure integration, education, and employment of immigrants to contribute effectively to pension systems. It can be done!

Looking back at your Nobel Prize-winning research, what implications have emerged that you could never have imagined at the time?

My prime contribution to the pricing of derivative securities was to develop a mathematical model that proved a dynamic trading rule in the underlying asset could be followed that would precisely reproduce the payoffs to any derivative contract contingent on that asset and the amount needed to fund that portfolio. The portfolio became known as a «replicating portfolio» and it created a production algorithm for manufacturing any financial product e where the value of the portfolio replicating portfolio is the production cost.

What we have learned since is that financial reality is more interconnected, and more human than any model can fully capture. Also, I can add that my work brought widespread use of mathematical models in financial markets, fueling the growth of quantitative trading and algorithmic strategies. As a result, Financial Markets became increasingly self-referential and model-driven, where strategies based on the same assumptions caused herding and flash crashes. That is, the «illusion of precision» made it easy for institutions to underestimate real-world complexity.

Finally, the Black-Scholes-Merton model paved the way for modern portfolio insurance, hedging strategies, and risk decomposition; tools that are now accessible to even retail investors. The widespread availability of derivatives and structured products has made financial markets more inclusive but also more fragile, as inexperienced investors take risks they do not fully understand. This has led to the rise of «do-it-yourself» derivatives trading via apps, something unimaginable in the 1970s. These are just some examples.

What advice would you give to your students and to young economists today who choose to pursue this field of study?

My advice today is consistent with the advice I always give my students which is: Models are powerful tools for understanding how things work, predicting outcomes of actions, and thereby, solving challenges. Do not just learn the models: understand their limits. Do not confuse models that are precise but always involve abstractions and therefore incomplete descriptions of complex reality. Incompleteness assures us that any model no matter how complicated can fail. There is no one best model for anything. The best model is a triplet (the model, the user of the model, the purpose of the model). In another word, master the mathematics and theory, but always ask: «What assumptions is this built on?», and «What does this model ignore?». The bottom line is to be literate in math, and fluent in reality. The most important step in the model is determining the abstractions one makes: what is included in the model? What is left out? I call this part of building the model «The art of the science», and it applies to every science.

Also, be the kind of economist who remembers the people behind the data. That is where your impact will truly be felt. Let purpose, not prestige, guide your path. Follow your passion and learn to communicate complex ideas clearly.

Riproduzione riservata © Giornale di Brescia

Iscriviti al canale WhatsApp del GdB e resta aggiornato

@Economia & Lavoro

Storie e notizie di aziende, startup, imprese, ma anche di lavoro e opportunità di impiego a Brescia e dintorni.